Digital transformation is having a significant impact on the financial sector. Fintech applications allow the automation of complex processes and decision-making with the highest level of accuracy. AI applications in fintech include:

- Smart credit scoring

- Lending software

- Robo-advisers

- Natural language processing solutions for customer support and portfolio optimization

- Fraud detection

- AI in fintech data classification

According to Accenture’s research, by 2030, AI will add $1.153 billion in value to the financial industry and will allow it to achieve $1 trillion in cost savings.

AI software increasingly automates Manual, repetitive tasks, leaving more time for employees to concentrate on more creative and valuable assignments. AI augments the workforce with smart analytics, accurate predictions, and personalized customer service. As a result, financial service companies enhance operating models, upend competitive dynamics, ensure efficient compliance, and drive enterprise growth. Let’s take a look at both general use cases and business cases from our experience as AI developers.

AI in FinTech: Business Case

AI Technologies and Their Use in Fintech

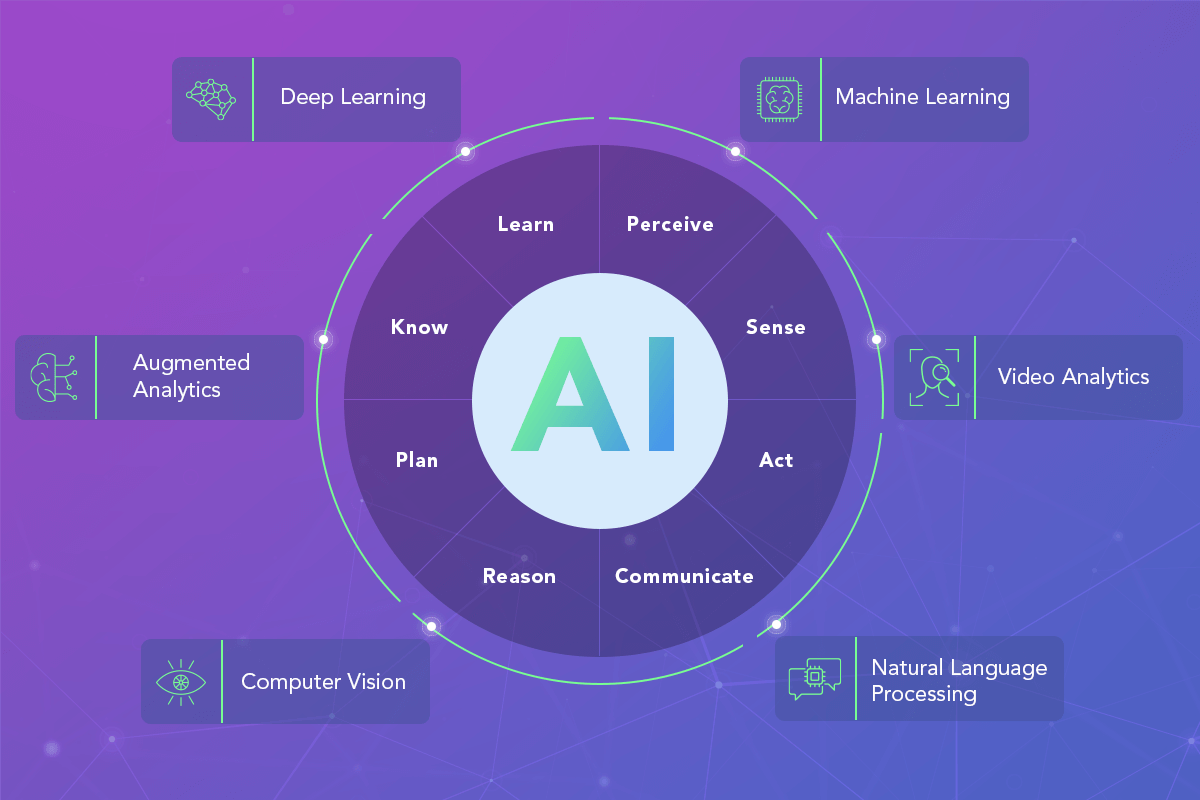

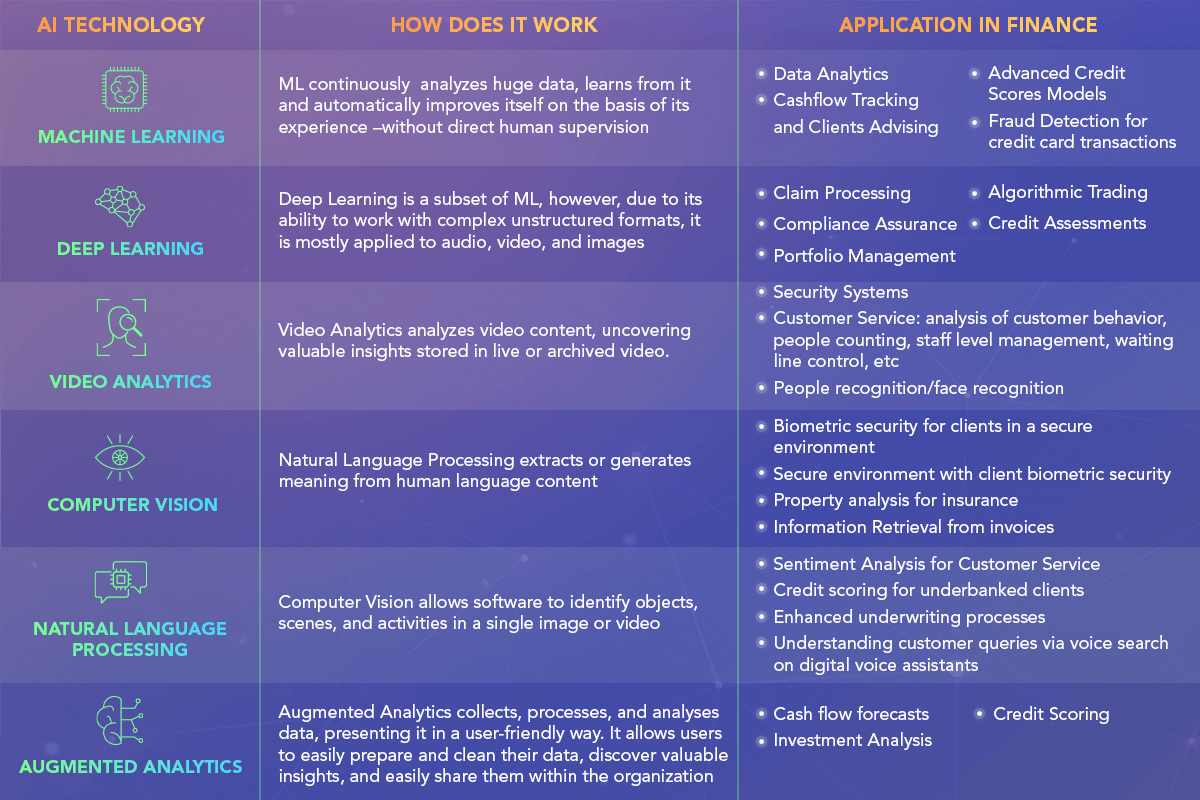

AI technology includes tools used in different areas and performs different functions. Among them are Machine Learning, Deep Learning, Video Analytics, Natural Language Processing, Computer Vision, and Augmented Analytics.

Depending on the purpose, environment, and technology stack, one or the other technology may be applied in the financial sector. For instance, computer vision can provide clients with biometric security and data classification for employees. Natural Language Processing (NLP) offers virtual assistants and chatbots for customers and the workforce. Below is a brief overview of technologies and their applications in finance.

According to Autonomous Research, by 2030, AI technologies will allow financial institutions to reduce their operational costs by 22%.

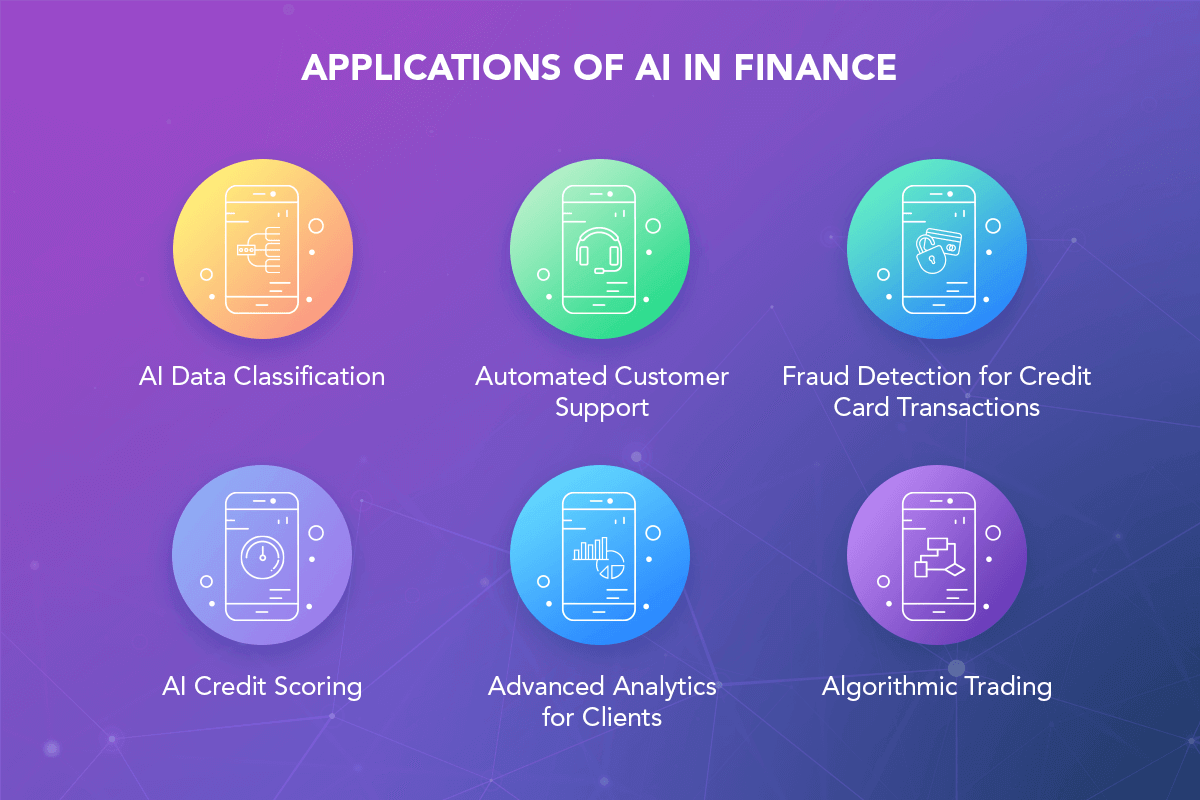

Applications of AI in FinTech

According to FinTechNews, around 50% of global financial services and insurance companies already use AI, which is expected to grow with technology advancements.

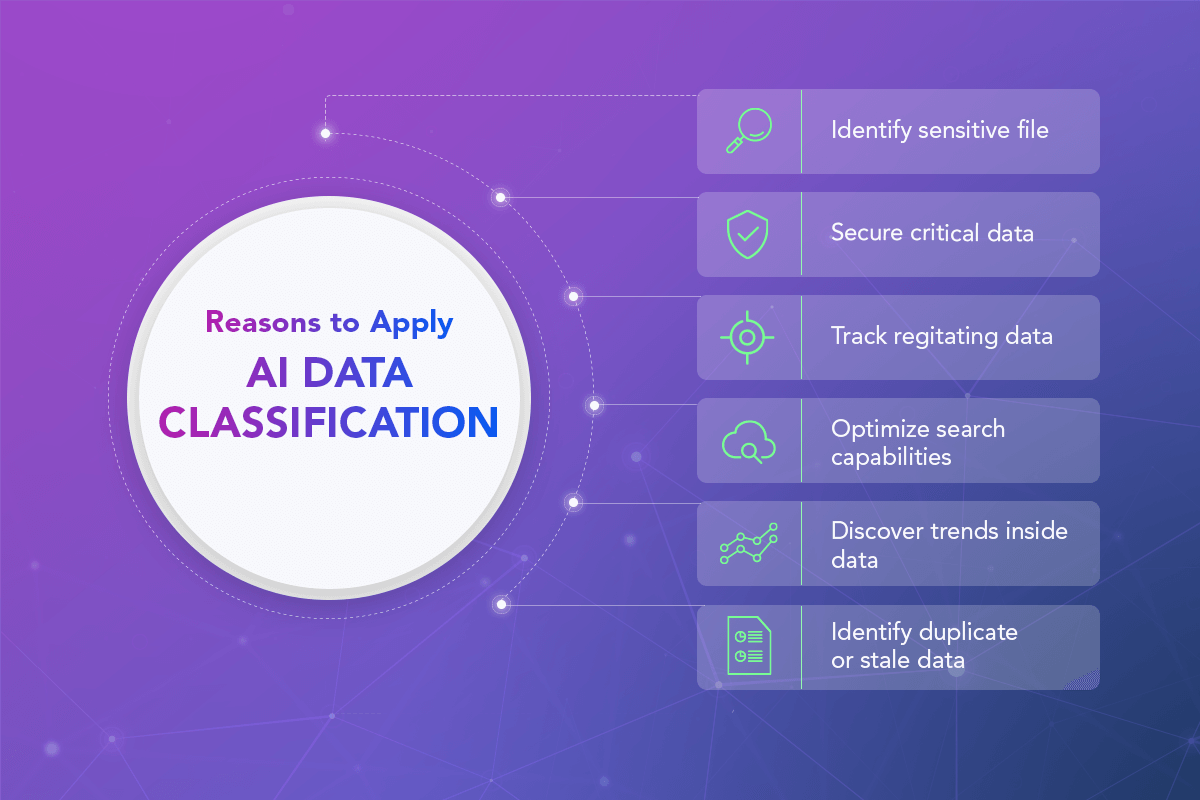

AI Data Classification

In such segments as banking, insurance, and capital markets, the documentary is huge, and documents and reports are not necessarily structured. To classify them manually is a time-consuming and error-prone task.

Learn more about how to classify financial data.

AI with Machine Learning capabilities can analyze the content of a given document and classify it under provided parameters. Documents can be cataloged regardless of the data type or format. As a result, the document flow is automated, releasing employees from routine tasks.

Softengi Business Case: AI-powered Data Classification

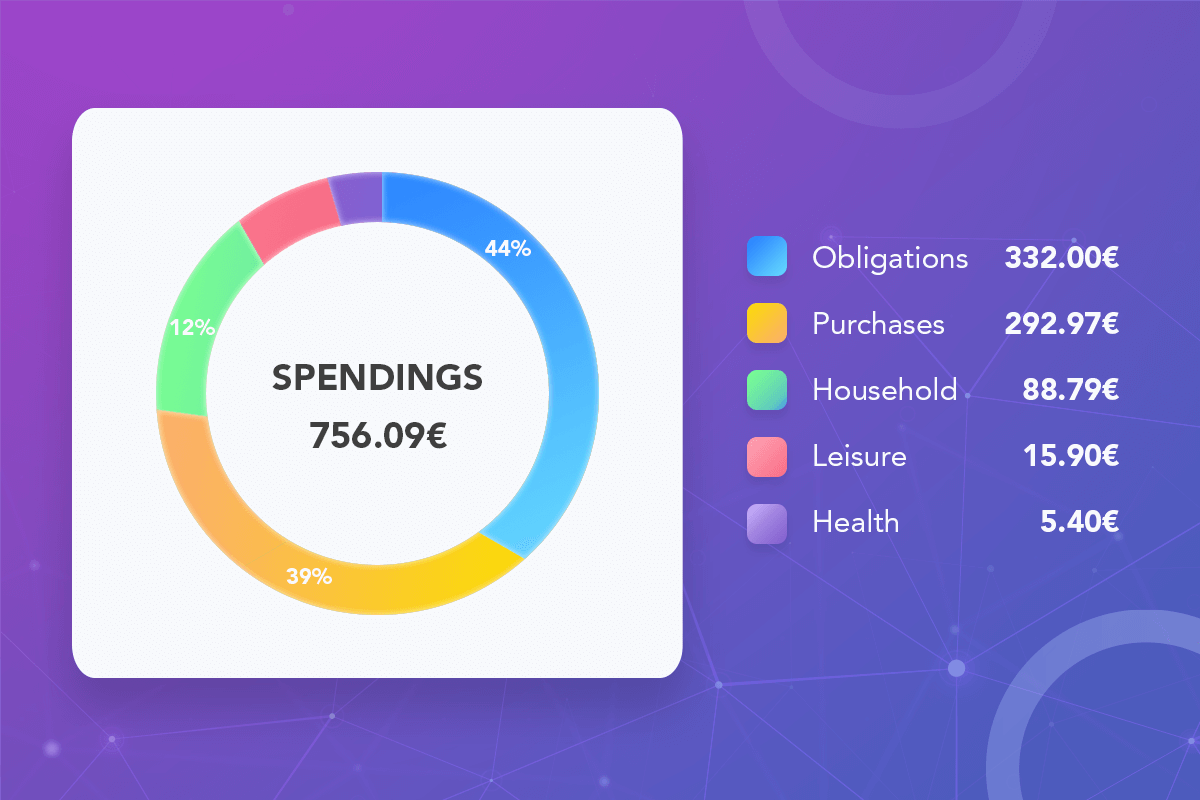

Softengi developed a transaction categorization solution that simplifies credit scoring. The solution allows agents to analyze transactions easily to create a credit scoring profile. The categories included groceries, fuel, healthcare, dining, and automotive expenses.

The ML-powered system analyzes transaction information from sales receipts, packing slips, and purchase confirmations. For example, if transaction documentation contained the name “Shell,” then AI recognized a payment for car refueling and marked the transaction as belonging to the appropriate section. Such tracking of users’ spending allowed the software to enhance the personalized finance management system and increase clients’ engagement.

Automated Customer Support

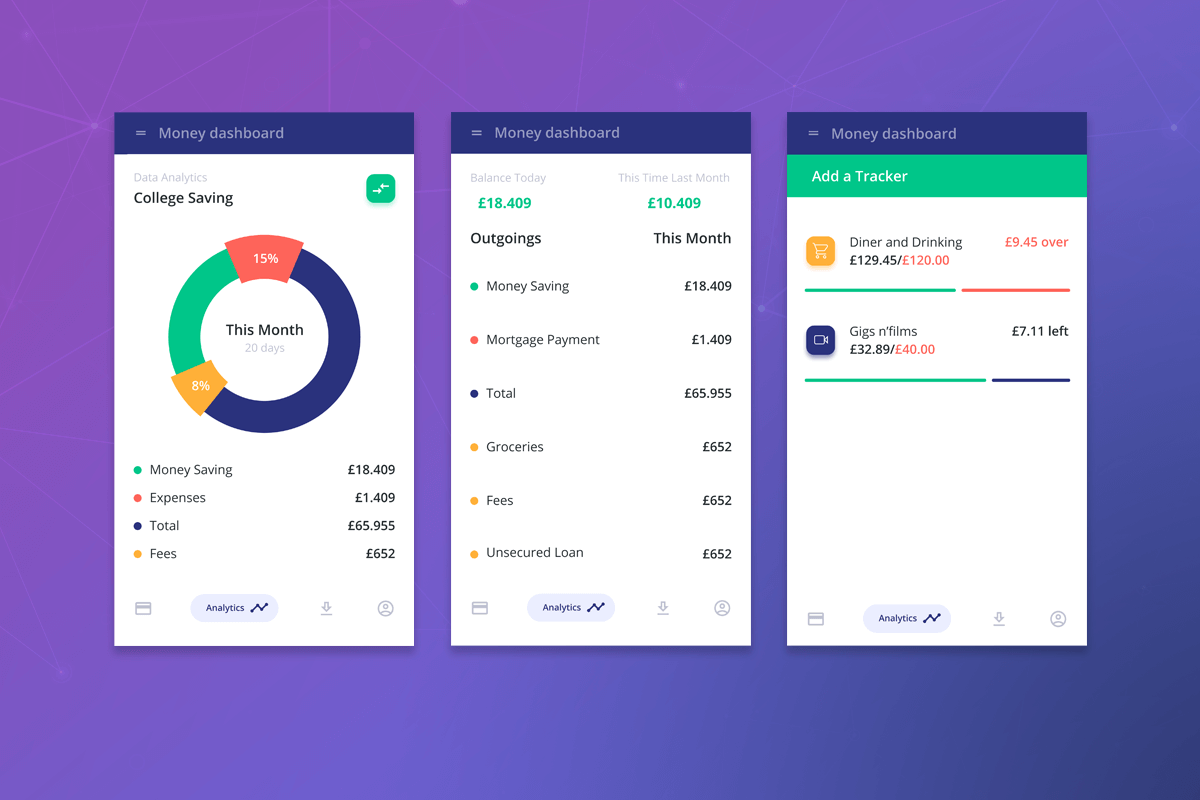

Applying AI and allying applications allows financial services companies to provide their customers with an efficient, engaging, and personalized environment. Customer-focused AI systems, such as AI financial assistants and chatbots, provide users with practical advice on managing their finances or giving efficient recommendations related to existing investment opportunities.

Moreover, AI can automate back-office operations. For instance, AI software can automatically extract meaningful information from unstructured data sources, such as invoices, order forms, and payments, providing employees greater visibility of companies’ workflow and operational performance. As a result, finance managers get access to real-time accrual reports, allowing them to monitor and control their clients’ cash flow more efficiently.

Fraud Detection for Credit Card Transactions

With the ability of AI to process huge amounts of data, financial services companies can detect fraudulent activities and prevent breaches before they occur. By detecting patterns in credit card transactions, ML-powered software promptly identifies anomalies, thus saving financial services organizations millions of dollars.

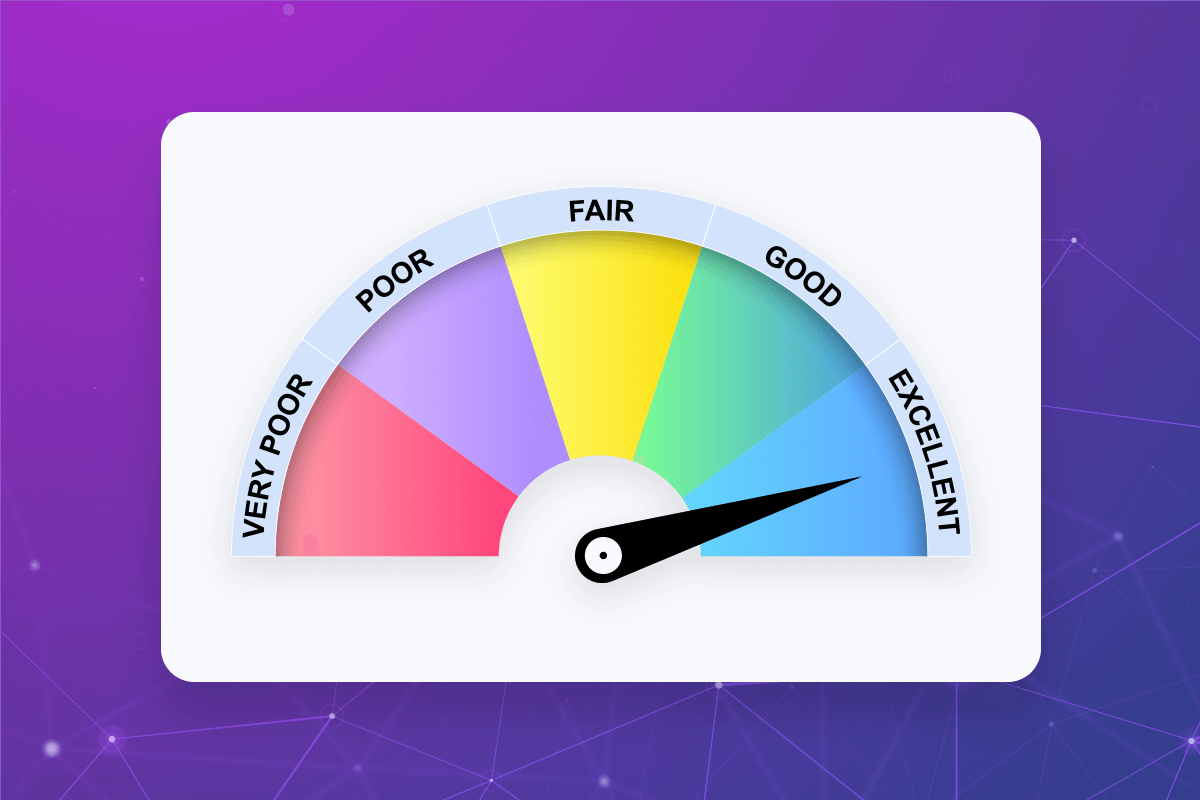

AI Credit Scoring

Due to ML capabilities and available historical data, AI can significantly enhance traditional credit scoring that is mostly focused on a cursory analysis of potential customers’ credit histories. However, conventional credit scoring is neither efficient nor error-prone, as it rejects applications from debtors able to repay their loans. AI can assess the creditworthiness of potential lenders more efficiently, ensuring that customers with high credit rankings receive the best offers.

Moreover, AI can use alternative data, such as social media, asset ownership, or employment data, that allow creditors to assess the financial situation of potential loan recipients more accurately. AI-powered tools are especially useful for assessing customers with limited credit history.

Advanced Analytics for Clients

Financial services companies can offer their customers AI Analytics apps that can monitor cash flow and make forecasts for financial departments. With Augmented Analytics based on AI technology, the application can estimate the amount of money that will move in and out of business within a short-term period, for instance, next week or month. AI analytics software can notify if a company needs to cut overheads, look for new investments, or focus on generating sales.

Learn more about Augmented Analytics.

Algorithmic Trading

Traders, brokers, and investment funds increasingly apply AI to their trading strategies. This is because AI offers a data-driven view of the current situation, makes accurate forecasts, and can trade with small spreads quickly. Moreover, by constantly collecting and analyzing various data from news, social networks, and specific websites, AI can analyze current events and trends in-depth and build behavioral models during business turmoil.

AI Business Process Automation

Today, most consumers and banking organizations are familiar with AI intelligent automation in financial services.

According to Capgemini, the financial services industry is expected to add around $512 billion in global revenues by implementing AI automation solutions.

Due to its ML and DL capabilities, AI can produce intended answers or actions that serve to improve the speed and accuracy of internal processes. For instance, JP Morgan, with its ML system “Coin,” has saved 360,000 hours of lawyers’ and loan officers’ work by autonomously reviewing and interpreting commercial loan agreements.

Business Case: Document Management Software for Bank of Georgia.

Softengi Business Case

Softengi has developed a smart parser at the request of a financial services company. The NLP-based application recognizes documents and contracts, analyzes their content, and generates only relevant information. Specifically, this software was used to analyze many documents for obtaining a loan, such as a passport, a financial statement, a cash flow projection, property documents, etc. The software allowed the company to automate the processing of documents and hence improve its productivity.

Tips for Financial Services Companies that Apply Digital Transformative Initiative

Reduced paperwork, better customer support and engagement, and improved analytics are just some of AI’s benefits for financial companies. But how to implement AI into established business processes? Here are some essential tips.

1. Apply AI in FinTech Strategic Plans

Deterioration of traditional profit strategies, volatile competitor landscapes, technological innovations, and changing customer expectations call for a new perspective on the financial services business. Thus, we recommend that financial services companies explore AI technologies and their applications in Finance and prioritize those that meet their challenges and objectives.

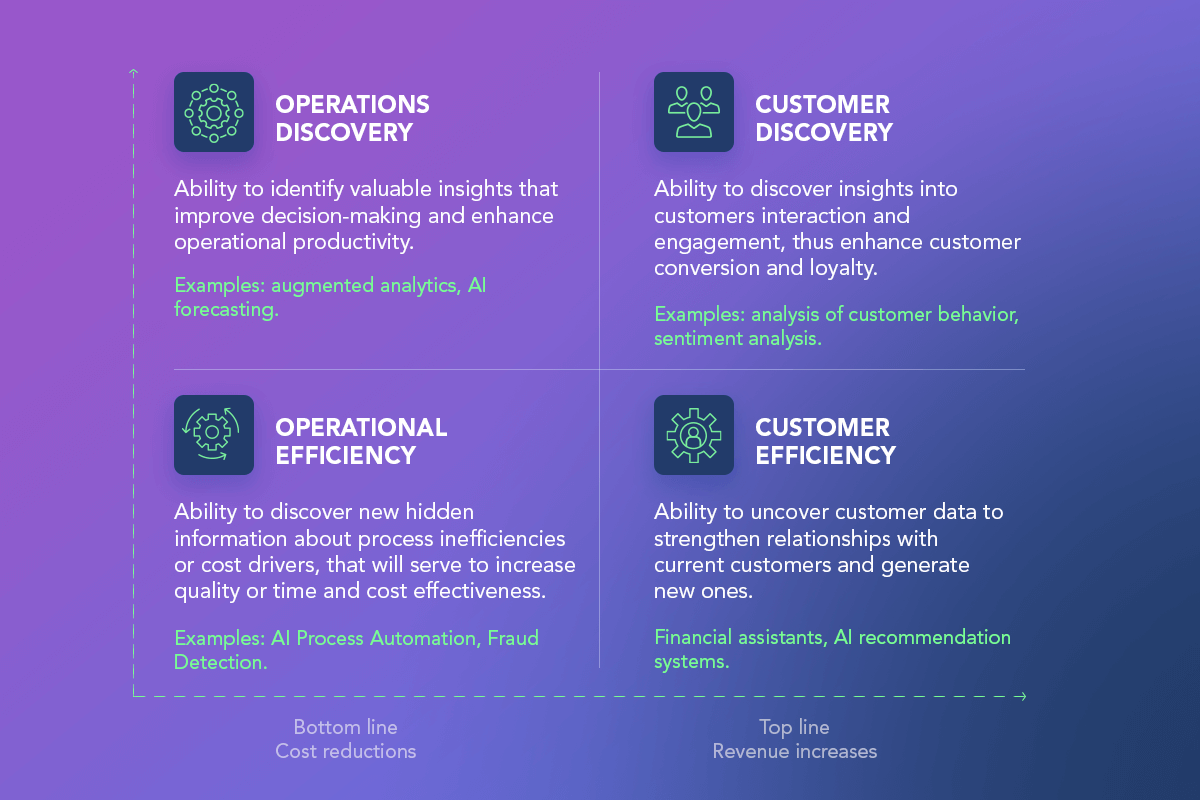

2. Consider AI for Operational Processes and Customer Engagement

The two major areas where AI can bring value are operations and customer service. By implementing AI technologies, financial services can gain four result types: operations discovery, customer discovery, operations efficiency, and customer efficiency. Operations and customer discovery refer to insights uncovered with ML-powered tools that allow companies to identify cost drivers, market trends, or novel criteria for enhanced customer segmentation.

On the other hand, AI improves the efficiency of both operations and customer services and, as a result, enhances the speed and accuracy of internal processes and improves customer conversion and loyalty.

3. Start Small

It is not necessary to start implementing multiple complex applications at once. Start small and then scale up. Starting step-by-step will allow to release an application faster and extend its applicability over time. AI applications can be iteratively scaled up, so financial services companies can expand their capabilities and reap increasing benefits over time.

4. Entrust AI Software Development to Professionals

Although an increasing number of startups and newly emerging software service companies offer numerous AI solutions for fintech, it is quite a challenge to find an appropriate vendor.

Creating an efficient AI solution that meets the customer’s needs and desires requires a proper tech stack, professional talent, and great business experience, avoiding pitfalls and tailoring the AI application to companies’ objectives. By applying the most advanced AI development practices and tools, Softengi, with more than 20-year experience in the IT field, can help you harness the power of AI to answer your most complex challenges.

Contact us to discuss the implementation of AI into your workflow.