Digital transformation is having a significant impact on the financial sector. Data science in finance is the most applied technological innovation, which allows fintech applications to automate ever more complex processes and decision-making with the highest level of accuracy.

Transaction Categorization: Business Case

AI becomes an effective tool for the financial sector as it helps with:

- Making data-driven decisions;

- Offering customers relevant recommendations to improve the engagement rate;

- Automating numerous repetitive tasks;

- Categorizing tons of data faster and with higher accuracy;

- Helping with transforming hand-written documents into digital;

- Decreasing expenses because of automated fraud detection.

According to Business Insider, the aggregate potential cost savings for banks from AI applications is estimated at $447 billion by 2023, with the front and middle office accounting for $416 billion of that total.

What can motivate financial companies more than savings? Read how we used AI to help a loan company automate and enhance the mechanism of creditworthiness assessment and to unburden the team from repetitive work.

Business Case: US-Based Financial Service Company

Softengi developed tailored machine learning algorithms at the request of a financial service company, and the result exceeded the customer’s expectations. The company, which chose to remain under the NDA, offers data-focused solutions for the lending industry.

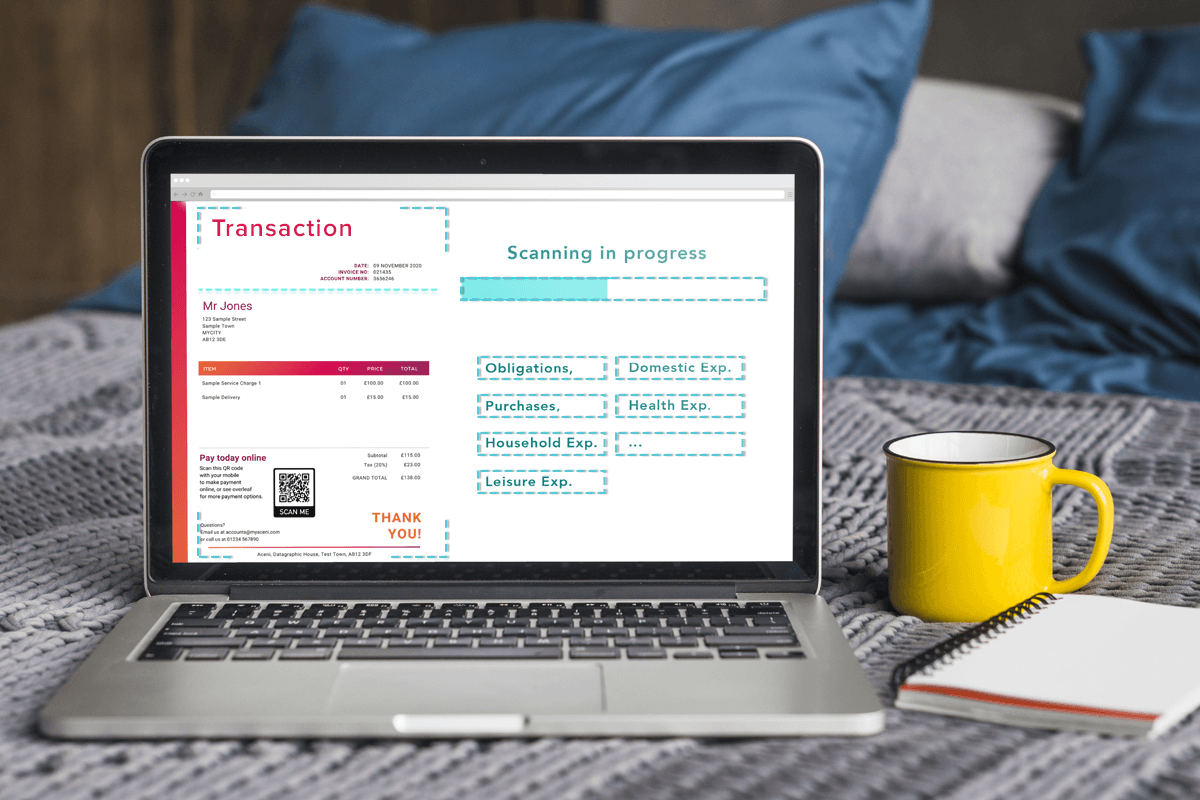

The designed ML algorithms allow the company’s application to recognize various transactions and analyze their content, generating only relevant information. Specifically, Softengi enabled the software to analyze a huge number of transactional documents provided for obtaining a loan. Using data science in the finance landscape and its algorithms allowed the company to automate the processing of transaction documents and improve workflow productivity.

The Client Company

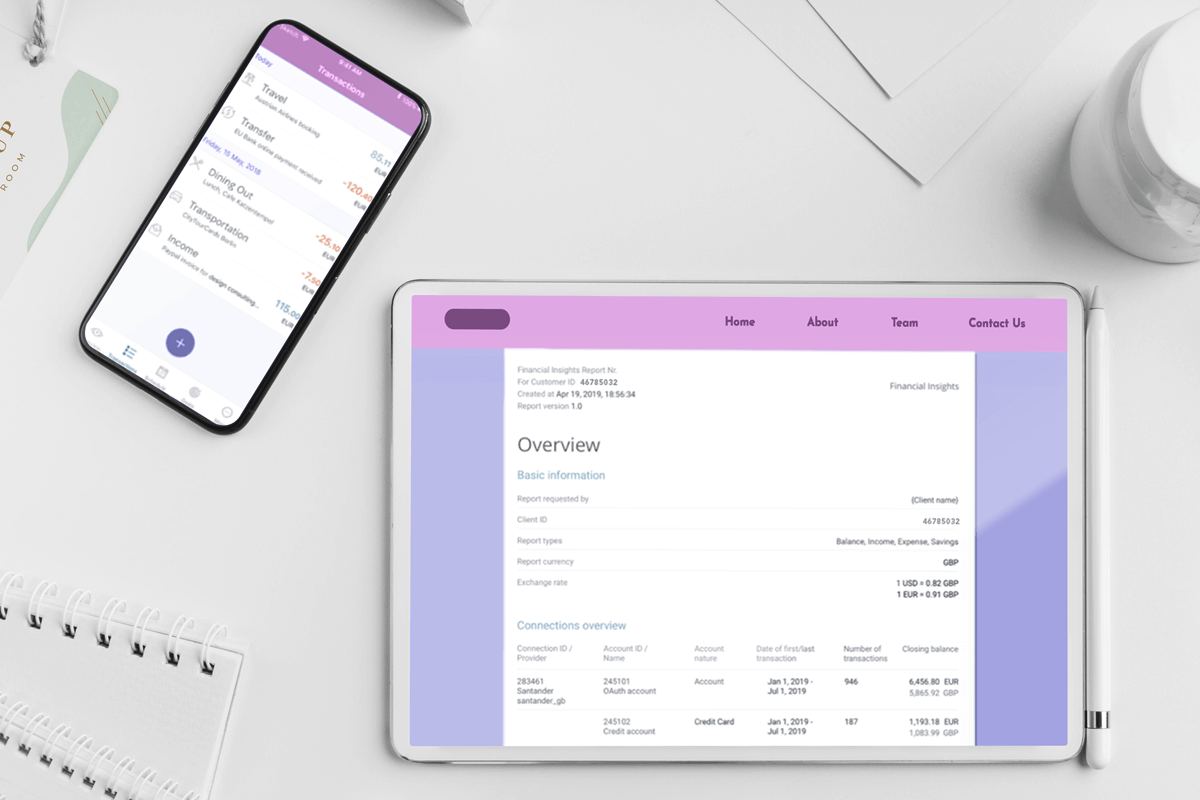

In essence, the service provider gathers large amounts of financial data from various institutions as well as organizations around the world and analyzes it with Machine Learning techniques, classifying gained information and structuring it in a user-friendly way.

Softengi’s client is a service provider of lending solutions that allow making more accurate and timely loan decisions, automating the whole lender information processing. Utilizing data science in finance, machine learning algorithms, and both historical and real-time data, the company’s software is able to verify borrowers’ identities, account numbers, as well as balance in real-time.

The Problem of the Client Company

At its core, lending and credit scoring is a Big Data problem. Conventional credit scoring is neither efficient nor error-free, as it rejects applications from debtors able to repay their loans.

To assess the creditworthiness of the individual or business that took out the loan, the finance companies have to manage a large number of various forms of data available and identify the percentage of probability that this person will pay the loan. The more data a company has about an individual borrower (and how similar individuals have paid back debts in the past), the better it can assess their creditworthiness.

The client company approached us to help it efficiently process financial data and classify transactions in various categories with high accuracy. The solution must be able to automatically identify transactions by their source or comments that the customer includes to describe the transaction and classify it into inappropriate categories.

The Solution

For this task, Softengi harnessed machine learning, data analytics, and data science in finance matters. Softengi developed a system that classifies financial transactions into various categories, among which are:

- Obligations;

- Purchases;

- Household expenses;

- Leisure expenses;

- Domestic expenses;

- Health expenses.

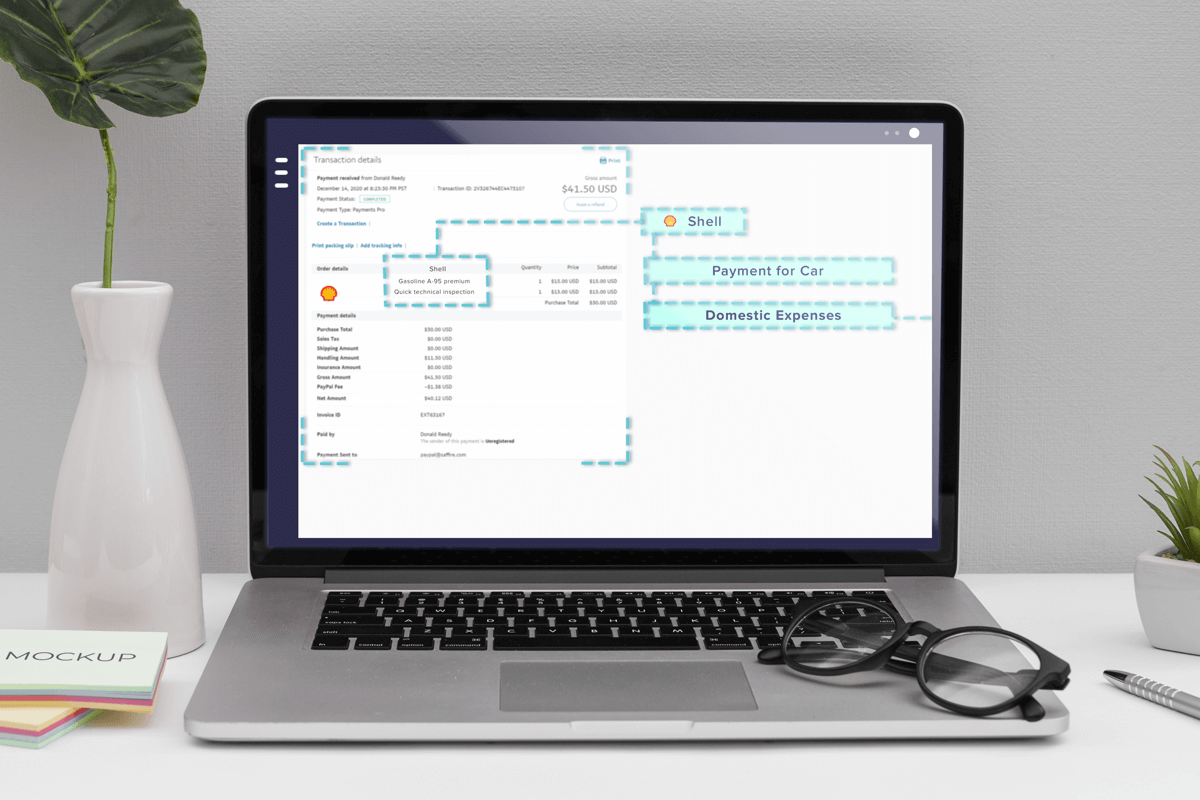

Embedding data science in finance, the software enables the company to automatically analyze available transaction information derived from sales receipts, packing slips, and purchase confirmations.

For instance, if transaction documentation contained the name “Shell”, then machine learning technology recognized a payment for car refueling and marked the transaction as belonging to the appropriate section, namely domestic.

Technologies used: Azure Machine Learning, .NET, Python.

The Result

Today, the client company can better manage Big Data, effectively processing and categorizing it. Applying data science in the finance context allowed Softengi to design ML-based algorithms that enabled the client company to classify a large number of various transactions, thereby enhancing its lending scoring and banking services.

PEOPLE ALSO READ

WhTech-WMS: Warehouse Management Software

With WhTech-WMS you can manage access and always know the location of your assets. It allows you to create custom reports and keep an eye on real-time alerts due to crashes or emergencies which gives you the opportunity to always monitor and understand the status of your equipment.

Police Records Management System For Caribbean Countries

Softengi designed, built, and installed the Police Records Management Information System (PRMIS) for the Caribbean region.

Industrial Asset Tracking: IoT Solution on Guard of Coal Mines

Softengi developed an IoT system that retrofits mining facilities with real-time underground tracking, automated dynamic gas detection, advanced connectivity, and alarm.