In the FinTech industry, the use of Artificial Intelligence (AI) and Machine Learning (ML) on par with Big Data, Data Mining, and Deep Learning has considerably grown over the decade. AI Transformation in FinTech represents an integrated part of the Worldwide Industrial Transformation. It has been triggered by the continuous reshaping of the FinTech consumer market from Millennials to Gen Z being spurred by Baby Boomers.

Transaction Categorization: Business Case

This technological boom has brought to FinTech a full tray of new efficient products focused on early threats and fraud detection, risk prediction, customer support, and back-office automation. Ron Shevlin Senior, a Forbes contributor, calms the financial marketers down, saying that they do not need to try hard to decode Gen Z (6-24 years old), their target audience because nobody was decoding the Millenials (41-56 years old) in their time.

“Financial marketers must reach out to Gen Z right now or their window of opportunity may slam shut forever.” Don’t believe it. Warnings like this are reminiscent of those from 10 to 15 years ago regarding Millennials. Roll the clock forward to today, and three megabanks—Bank of America, Chase, and Wells Fargo—have 44% market share of Millennials. And they were hardly the ones “decoding” Millennials before it was “too late.”

Obviously, the lives of 24-year-olds are much more digital than any previous generation ones. This presupposes that they are more likely to choose digital than physical ways of organizing their financial lives. As a result, financial institutions are forced to provide their clients with ever-new digital tools to handle financial transactions, legal issues, and service problems.

At the same time, he mentions that financial marketers should have entire programs developed for retirees and seniors because the Millenials will be helping their elderly relatives to manage their finances, using new AI tools that financial institutions would introduce for their clients.

According to Forbes, the FinTech industry received more than $350 billion dollars funding in the last 10 years.

AI in aerospace and healthcare got a similar volume of investment and, unlike FinTech, has accomplished several great breakthroughs. Not so long ago, FinTech launched a new branch of industry, intercepting finance and longevity. Today, we can meet Financial and Preventive Medicine Hubs in the USA, the UK, Germany, Israel, and Singapore.

McKinsey takes a more practical view of how financial institutions should employ AI.

This article delineates the main benefits of Machine Learning and Artificial Intelligence for the FinTech industry, financial institutions, and end clients:

- Fraud detection

- Predictive Analytics

- AI-driven Chatbots

- AI for Back Office

Fraud Detection

Traditionally, fraud detection systems for financial institutions followed the pre-defined ‘if X then do Y’ algorithms to flag suspicious users from completing transactions. Though, the high number of transactions makes it hard to process every transaction, identify patterns and instantly provide intuitive rules to flag the suspicious ones. Also, the system may often mark a “clean” transaction as a fraud one, therefore terminating the whole operational process. This can lead to lower customer satisfaction as well as their loyalty to the financial institution.

Machine Learning (ML), Big Data, and Artificial Intelligence create more precise algorithms and build more accurate patterns based solely on data, says PwC.

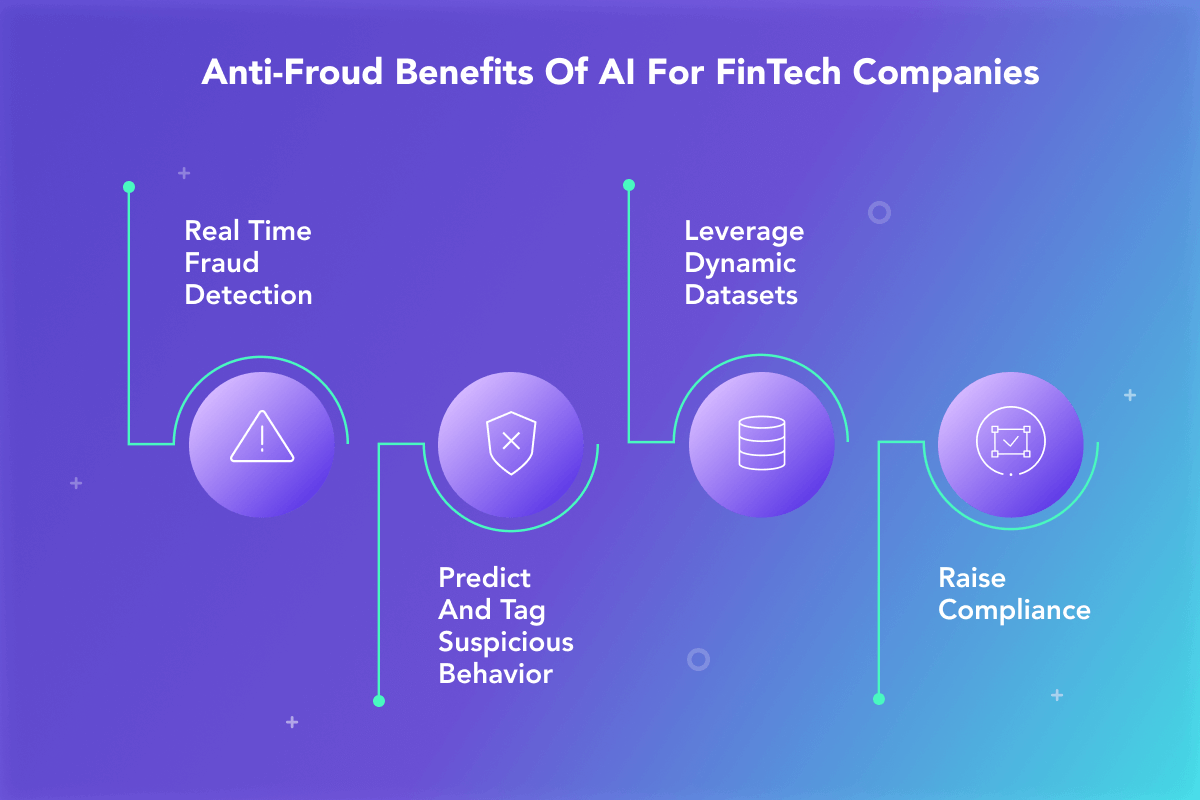

They allow real-time fraud detection, predicting and tagging suspicious behavior of your clients, and leveraging dynamic datasets in your Back Office as your ML-powered systems constantly learn from experience. This leads to better company compliance with anti-fraud regulations, reduced risks of penalties, and preserved trust and reputation on the market.

Predictive Analytics

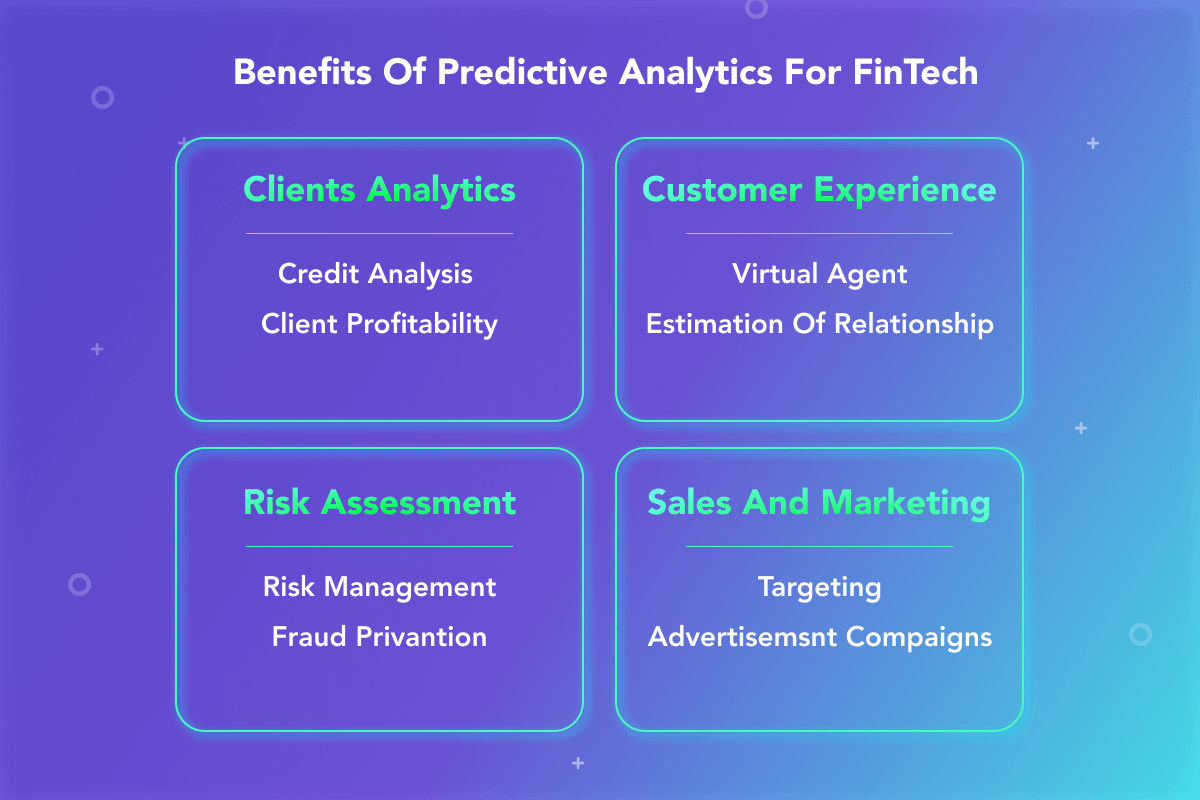

According to The Financial Brand, in FinTech, Predictive Analytics serve at least for Client analysis, Risk Management, Customer Experience Management, Sales and Marketing.

Predictive Analytics is successfully applied for product and channel strategy, risk and capital modeling, sales, and channel performance. Predictive Analytics for financial business is often used as part of complex SaaS platforms, for example, a bank’s platform for lending finance to business owners. Predictive analytics systems can analyze the borrower’s history, calculate credit scores, and prevent high-risk operations.

Predictive Analytics, with its Data Mining techniques, collects and processes a massive amount of data about your borrower, finding patterns in the history of their behavior and predicting their future actions due to Deep Learning algorithms.

AI makes financial operations easy both for clients and financial institutions:

- Provide a credit score calculator;

- Gather Credit Reports via third-party services;

- Identify a loan amount based on the Tier of the borrower.

Machine Learning is also used to pre-approve smaller loans based on the borrower’s data. Predictive Analytics systems may include:

- Verification calls recording from a bank to a potential client;

- A sustainable database that allows fast aggregation of huge volumes of data;

- Simple integration tools.

Business owners can benefit from AI loan solutions in several ways:

- Loan qualification;

- No paperwork, E-application;

- Transparent decision-making process;

- Loan decisions within minimum working days.

To analyze a business in which a borrower or a financial institution wants to invest, FinTech companies apply Natural Language Processing (NLP) and Text Analytics to:

- Filter large amounts of unstructured text data services;

- Monitor large databases across millions of financial, legal, and business documents;

- Support various languages.

Thus, financial institutions can be secured in their loan operations. There is another broad area where financial institutions apply NLP and Text analytics, namely marketing, lead generation, and retention, PR, and sales. NLP allows to find information about their target audience’s habits and preferences. NLP and Text Mining solutions can filter text data, detect topics in real-time on social media and other platforms in multiple languages, and visualize the output.

FinTech companies use their expertise in REST, Spring, and Java to accomplish such a challenge. They run complex meaning-based filtering, topic detection, and semantic search. FinTech companies process big volumes of text data, encoding the semantics of Natural Language elements into semantically grounded binary code.

Read more about AI for Financial Services.

AI-Driven Chatbots

Gartner Research states that, by 2020, consumers will have managed 85% of their business communication with banks via chatbots.

Users of FinTech services are more likely to be serviced by AI support chatbots that offer:

- 24-hour support;

- Instant response;

- Basic servicing requests.

AI chatbots raise client satisfaction much higher than classic chatbots do, and they are cheaper for the FinTech industry than human customer support service. Also, AI chatbots analyze information about clients and their requests, storing it in your back office system. The machine uses this information to leverage its base and learning capabilities. A financial institution can use AI chatbots to refine its services. Let’s consider an inspiring example of Bank of America and its usage of AI chatbots.

The Financial Times mentions Bank of America to be widely using the Erica chatbot:

Erica, the same chatbot serving millions of their clients, proactively sends insights about users’ spending and saving habits. On average, 150,000 people click on these insights every week, to gain a perspective on how to improve their finances.

AI for the Back Office

Operational processes are the core of the financial business as they are one of the main determiners of a company’s success. AI provides flawless financial transactions, instant payments, and reduced risks. All these demand processions of enormous data volumes that are being constantly gathered. In this case, fully-automated processes are the ideal solution. Software engineering companies incorporate AI in financial institutions for Back Offices to:

- Monitor backlogs;

- Manage processes;

- Increase backlog efficiency.

Learn more about about Classification of Financial Documents.

AI makes the Back Office of a FinTech company more effectively operate by automating auditing processes, verifying compliance documentation, and streamlining data migration.

Often work processes require human intrusion, approval, calls, and file sharing that dramatically hinder automated processing. That’s why operational departments of IT and Software Engineering companies apply Symphony and the iPushPull workflow applications and provide an integrated means of data approval. Also, FinTech companies use APIs that allow financial institutions to keep their legacy systems and architecture.

Conclusion

Machine Learning and Artificial Intelligence in the FinTech industry are being widely discussed and recommended by many trustworthy resources. Some recommend full transformation with SaaS platforms. Others suggest a combination of classic management with AI elements. This article outlined the most demanded Artificial Intelligence and Machine Learning applications for FinTech, including Fraud Detection, Preventive Analytics, AI-driven chatbots, and AI for Back Office operations. The more considerate and grounded decisions the businesses make, the more fruitful solutions FinTech companies can provide to financial institutions and end clients.