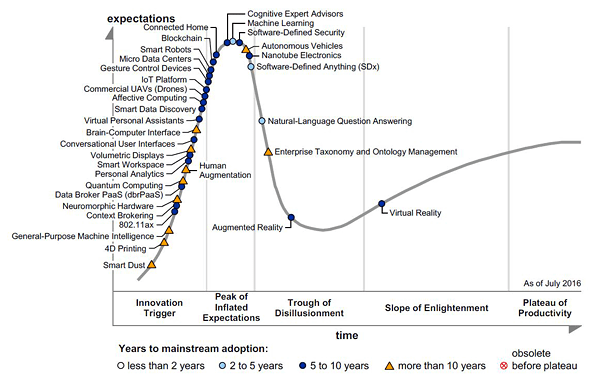

There has been a lot of buzz around Blockchain technology lately. Actually, Blockchain is now one of the most hyped, hotly debated, controversial, and yet promising technologies since the inception of the Internet. Gartner included it in the list of technologies of its Hype Cycle for Emerging Technologies. Forbes stated that Blockchain “will transform and reinvent organizations, ecosystems, and economies,” and recently, the technology appeared on The Economist’s cover and was called “the trust machine with extraordinary potential.” The fact speaks for itself.

Statistics show that Blockchain is mostly associated with Bitcoin, Ethereum, or alternative cryptocurrencies for many people. However, using this cutting-edge technology to underpin cryptocurrencies is just the tip of a huge iceberg. Indeed, Blockchain has the potential to trigger a revolution in a significant number of industries, including the Financial Sector.

Of course, as with any system, Blockchain has many pros and cons. We decided to examine them in more detail. But first of all, what is the essence of Blockchain, and how does it work?

Blockchain as a Technology

Blockchain was elaborated in 2008 and developed a year later by an as-yet unmasked person (or persons?) named Satoshi Nakamoto and was the backbone of Bitcoin – a “peer-to-peer electronic cash system.” In fact, it is a technology that can transfer money, property rights, stocks, deeds, art, files, digital licensing fees, intellectual property, and even votes from one subject to another via the Internet.

Technically, Blockchain is a type of distributed digital ledger (which is actually a huge open database) that permanently stores records of all transaction data on multiple computers in a peer-to-peer network worldwide. This ledger is decentralized: there is no central authority, and no intermediaries are engaged in conducting and validating transactions. So, the transactions are broadcast across the entire network, and its users act as a collective notary certifying the validity of these transactions, checking their format and signatures. Here, the “consensus” principle is utilized.

All validated transactions are then configured into lists of records called blocks. Each of these blocks has a timestamp and is linked to the previous block using a cryptographic hash function (i.e., an original piece of information is transformed into a code known as a “hash,” and each block includes a hash of the previous block). Altogether, the linked blocks form an unbroken sequential chain (see Figure 2), and that is where the technology’s name comes from.

Advantages of Blockchain

1. Increased efficiency and speed of transaction processing. Blockchain ensures quick transaction processing, whereas, in the conventional scheme, this process might take up to several days.

2. Security and reliability. For many years, the system has been subject to numerous attacks and various threats, but none of them succeeded. So, Blockchain is a practically hack-proof system resistant to hacking attempts, theft, or forgery. Records stored in it are considered to be incorruptible and tamper-proof. This is possible due to:

a) Decentralization. Transaction data is not stored in a master location but distributed across a chain of multiple computers, and there is no particular managing body. By storing data across the network, Blockchain eliminates the risks that come with data held centrally. It lacks centralized points of vulnerability and failure that can be exploited by hackers. Besides, data distribution makes it harder (and way too expensive!) to attack the system. So, it provides better resistance to malicious actors and external attacks within the system;

b) Data protection against modification and deletion, which is one of the main advantages of Blockchain. The chain records the entire non-reversible history of transactions in a public ledger. Old transactions are preserved in the ledger forever, and new transactions are added irreversibly. Any single change of any bit of data will result in a change to the hash value, and the new hash will not match the old ones. So, any attempt to tamper with any part of the Blockchain will be immediately apparent;

c) Distributed transaction validation system, which ensures that nobody can tamper with the records, and anyone on the network can check the ledger and see the same transaction history as everyone else;

d) Reliable and time-proved cryptographic hashing technology and use of digital signatures;

e) The use of public and private keys. A public key (in fact, a long, randomly-generated string of numbers) is a user’s address within the Blockchain, whereas a private key is some sort of password that gives its user access to his/her digital assets and allows to interact with various capabilities supported by Blockchain.

3. No need to involve intermediaries (trusted third parties), such as slow and costly payment systems, brokers, agents, front office, or back office help, to process transactions. This is possible because Blockchain is publicly accessible and well-designed to replace the functions currently assigned to intermediaries, such as handling financial transactions, ensuring a trustworthy trading environment, securing contract compliance, or guarding against fraud. As a result, transactions can be faster, cheaper, more secure, and easier to access.

4. Cost cutting. By avoiding the use of intermediaries and overhead costs for exchanging assets, Blockchain can potentially save pots of money.

5. Transparency and openness. The information contained in the blocks can be quickly double-checked because anyone can access the ledger and see the validated transactions.

6. Anonymity. Notably, the program code of the network is open to all users, but they see only the data on each specific transaction. The identity and other personal information remain secret.

7. Accuracy. The data does not get into the Blockchain system unless it is verified. Moreover, Blockchain removes typos and other human errors. So, the Blockchain data is accurate, complete, consistent, and timely.

8. Widely applicable technology. As Blockchain meets the need for a trustworthy record and has a great potential for development, it can be used in a variety of industries beyond the scope of cryptocurrencies. Attempts to use Blockchain include the financial sector, banking, insurance business, government and business administration, crowdfunding campaigns, execution and performance of contracts, real estate transactions, retail and manufacturing, healthcare, music selling, and even the organization of democratic elections.

Disadvantages of Blockchain

- Blockchain is unable to store large amounts of information. However, the technology is evolving, and in the future, this shortcoming may vanish.

- Some people say that, theoretically, it can be hacked. However, this would be possible only if 51% of users within the chain agreed and schemed a fraud and simultaneously changed the transaction data. In view of the current technological development, that is practically impossible.

- Energy-intensive use. Because of its distributed nature, Blockchain demands constant computational power in multiple locations that results in the on-going extensive electricity consumption worldwide.

- Yet uncertain regulatory status. The universal introduction of Blockchain has been impeded by its still unsettled regulation status. The use of this new technology will surely disrupt centralized institutions and bureaucracies such as banks, government authorities, or other parties handling transactions, and the latter surely fight it.

So, Is It Hot or Not?

Despite all the criticism and existing drawbacks, the technology is worth attention. One can assert that Blockchain offers companies cost-saving, productive efficiency, and competitive advantage.

Sergii Solomakha, the Leading Architect at Softengi, noted: “Blockchain is an independent and transparent technology that ensures security, anonymity, lower costs, and speed. Together with my colleagues at Softengi, we are ferreting out any chance to apply it in software development for various industries and support its spread. We agree that it is one of the most important inventions of the last decade.”