As there is so much textual information in the finance sector, financial entities resort to software based on natural language processing to better process it. These solutions are constantly developing and going live. This article describes popular and new NLP use cases in finance.

What is NLP?

Natural language processing is the capacity of software to understand human speech in voice and text. NLP is a part of AI.

Financial companies apply the capacity of machines to work with the text to find and analyze data in their domain. They can search both in free, unstructured data and in their own repositories. Companies utilize voice processing in smart means of voice communication.

In the finance industry, NLP can be used solely and in combination with other AI models. In this case, NLP represents the basis for such tools as ML, big data, data mining, and predictive analytics.

How AI Solutions Understand People

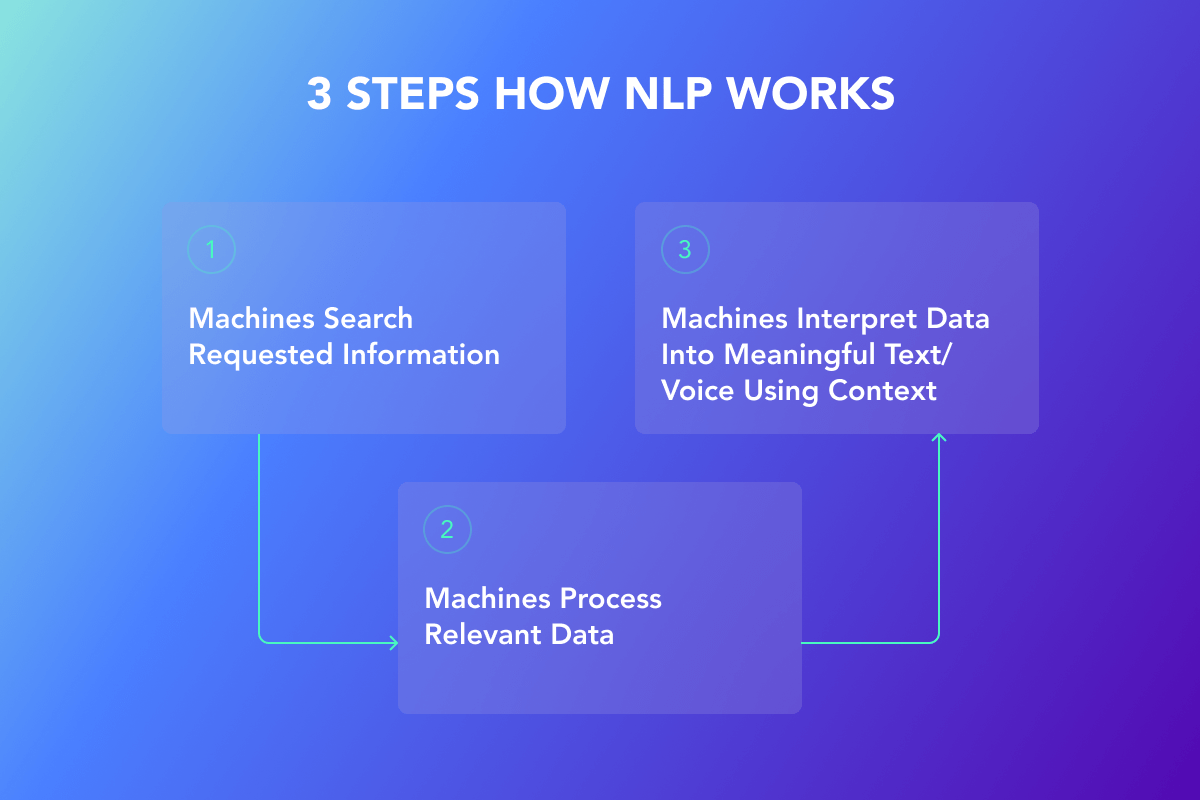

To make machines grasp people’s language, developers train algorithms. When generalized, these models go through 3 steps in their work.

Going through these steps, machines perform a number of important processes:

- Map inputs people’s speech into meaningful representations;

- Analyze the building of sentences;

- Analyze the meaning of words;

- Extract the meaning of the text;

- Deliver outputs.

| NLP’s capacity to extract requested patterns from free data and the capacity to interpret the raw textual information into meaningful insights represent the backbone of AI search, analysis, and prediction operations in the finance sector. |

NLP Use Cases: Intelligent Document Search

NLP-based solutions can find all relevant documents in free data. Financial bodies can need them for grounded decision-making. These solutions work due to NLP’s capacity to find patterns in large volumes of unprocessed data. If the solution cannot find documents, this means that they are not available in free sources or do not exist.

Automate Capture of Earnings Calls

NLP-based solutions can automatically capture earnings calls. Once a fiscal year or once a quarter, a public company makes an earnings conference call. They are aimed to inform the company’s investors about the earnings of the business. Brokerage firms, mass media, and financial analysts can be interested in them.

If they use NLP-based systems, they can get the companies’ press releases, call dates, general financials, key leadership changes, product updates, and new partners.

Automate Capture of Leaders’ Presentations

NLP-based solutions can automatically bring to financial bodies presentations of companies’ management. Periodically, companies’ leadership makes presentations or reports about their financial progress. Financial entities that employ AI systems can get many factual and analytical data in numbers and charts.

They can get an understanding of the company’s profitability, visions, and high-level project overview. This information can be interesting in terms of investment and analytics.

Automate Capture of Acquisition Announcements

NLP-based solutions will serve a great service while automatically finding news about the companies’ mergers and acquisitions. Financial institutions can be interested in the earliest information about the change of ownership of the companies and structural changes.

Voice Money Transfer. Experience with the Royal Bank of Canada

Royal Bank of Canada offers its clients a mobile application for voice money transfer. It is based on NLP, activated by voice, and can transfer money or pay bills. In this application, NLP is used to understand a client’s voice and to generate human voice feedback. This application uses Siri and works on smartphones with ios.

Clients can send money in three steps:

- The client calls the name of the contact and the sum;

- The client confirms the operation via this application;

- The client finalizes the operation with Touch ID.

Voice control of funds is very handy for banking clients. They can have more freedom in managing their finances. This raises customer satisfaction and loyalty. The authentication process in this solution is also handier than manually filling in passwords. It is built on voice recognition and NLP.

AI Сhatbots. Experience with Commonwealth Bank

AI chatbots are very popular with big banks. In 2018, Commonwealth Bank employed Ceba AI chatbot. It serves more than 6.2 million users.

“Ceba is available 24/7, can recognize approximately 60,000 different ways customers ask for the 200 banking tasks and will eventually be able to tell customers what they are spending their money on,” boasts the bank.

AI chatbots are built on NLP. This model can grasp the meaning of human speech and generate it. First, AI chatbots could only answer simple questions. But with the development of technology, they can be upskilled to personalized financial assistants.

Still, not all situations demand such a high level of a bot. Banks also need middle-level AI chatbots that serve regular clients’ incoming calls. They can answer clients’ questions, direct them to the company’s web and mobile resources, or switch the client to an appropriate specialist.

Central Banks and NLP

Central banks are responsible for the oversight and management of all other banks. Commercial and retail banks send their reports to the central bank. Though, the central bank does its own research.

NLP, together with other algorithms, helps identify gross, financially hazardous transactions. Furthermore, its major function is to find patterns in vast unstructured data.

Mark Context Data in Query Results

NLP can highlight the requested context in search results. For example, financial institutions can find all mentions of some policy, regulation, or event with their financial impact as a context. In this case, the system will generate all mentions of the query phrase and highlight the mentions with financial impact.

Analyze Financial Sentiments. Study of the University of Cornel

Financial sentiment analysis differs from sentiment analysis in, for example, retail or other domains. It does not use computer vision to see the customers’ faces. And obviously, it has a different purpose.

This type of analysis in the finance industry uses solutions based on NLP to find financial news and emotional, factual reactions to it. Further, they can forecast the market reaction to particular financial news in this environment. This forecast has a major impact on many areas.

One of the novel findings in this field was developed at Cornell University. FinBert offers financial sentiment analysis with pre-trained models. The authors suggest that pre-trained language models do not need many labeled examples. And they also can be trained on domain-specific data.

This means that developers can train and a rather fast army of NLP-based machines for a particular client or clients. It will find and forecast financial moods for them.

Understand Figurative Meanings of Queries

With NLP, financial specialists do not need to guess what search engines consider keywords or key phrases. Also, they do not need to know the words that the majority of users input in search. NLP can understand what they mean when they speak with neologisms and different figures of speech.

Prediction of Stock Fluctuations

Based on financial sentiment analysis and prediction of market reaction to financial events, AI solutions can predict financial consequences for companies. For example, if the stock price of the companies will fall or rise.

NLP for Digital and Challenger Banks

Digital and challenger banks rely more on NLP in cases where physical banks can utilize traditional means. For example, AI chatbots are the primary option for these banks, not human assistants.

Introduce Retention Programs

In general, clients of the banks are not satisfied with their banking services, states Entrepreneur reporting FIS study. It revealed that just 23% of clients feel happy about their banking services.

NLP and AI solutions can offer specific retention programs for the banking sector.

AI solutions can include multi-channel support of the clients via sites, social media such as Facebook, and mobile applications such as Whatsapp and Viber. AI solutions can do personalized offers.AI solutions can collect client’s feedback while servicing them.

Risk Assessments

Insurance companies are the first to utilize this function. They need to know the history of the client to issue an insurance policy. Also, they need to know what bills to collect and what to not. NLP can find all relevant information concerning clients and claims.

All banks utilize risk assessment. Credit risk assessment raises the probability of a successful loan payment.

Accounting and Auditing

With NLP and data analytics tools, financial entities can perform continuous auditing of accounts and transactions. In this way, management can feel more secure that they comply with accounting regulations and vet financial statements in a proper way.

It is worthwhile mentioning that AI auditing solutions cannot substitute auditor jobs. But they can rather upskill these jobs and raise the quality of the audit.

Segment Customers Based on Their Profiles

Companies can segment their clientele by having processed their account information. For example, the structure of their income and expenses. Doing it with NLP will take less time than the manual creation of filters.

Depending on their new segment, the clients can get specific information. For example, they can be offered new products that match their new status.

Financial Portfolio Optimization

Financial companies endeavor to allocate their assets in such a way that will preserve their best risk-reward balance. This means that they want to receive the best ROI while not surpassing the planned risks.

| Traditional Financial Portfolio Optimization | Smart Financial Portfolio Optimization |

NLP, with other models, can offer a different approach to solving this task. First of all, smart solutions will process free, unstructured data, and find relevant information there. Then, smart solutions will build multiple inter-relations. And afterward, smart solutions will balance the risk-return ratio. | NLP, with other models, can offer a different approach to solving this task. First of all, smart solutions will process free, unstructured data, find relevant information there. Then, smart solutions will build multiple inter-relations. And afterward, smart solutions will balance the risk-return ratio. |

Track Customer Spending Patterns

By applying NLP and big data, companies can create patterns of how clients spend their money. With this information, they can forecast the volume of funds that flows out per day or per month.

Offer Personalized Products

Personalization in offers is one of the main success factors in the financial industry.

On the front end, banks can raise sales by providing personal AI-adjusted products to clients via AI chatbots.

Using NLP, AI solutions can:

- Collect history information about clients in free data;

- Leverage it with their account history, and the bank’s products;

- Create adjusted offers to individual clients.

This can raise sales and dramatically save man/hours of the bank’s qualified personnel.

NLP is massively used in the insurance business.

All insurance policies that insurance companies grant to their clients represent personalized and AI-approved contracts.

For insurance companies, NLP is the first stage of the client’s history analysis. It recognizes all relevant information about the client in free unstructured data.

Collect Customer Feedback

NLP is the basis of AI voice chatbots that serve clients. They understand the client’s speech and generate answers using human language. All interactions of AI solutions with the clients are recorded and stored. Specialists of financial institutions can analyze them for better decision-making.

Conclusion

NLP and AI assist the financial industry in many areas of their work. NLP’s function in finance is to extract requested patterns from free data and to interpret the raw data into meaningful insights. This capacity represents the basis for all AI-human relations in the finance industry. Due to NLP, AI solutions can do data collection, analysis, alerting, and prediction. AI applications in finance can target from client support to risk prevention. But the strategic AI applications specific to finance are financial sentiment analysis and financial portfolio optimization.