According to PwC’s Global Fintech Report, by 2020, 77% of Fintech institutes are expected to implement blockchain-based solutions in their production systems and processes, and the share of payment companies using blockchain technology is estimated to reach 90%. The global financial system is believed to have become one of the most promising industries to reap benefits from implementing blockchain-powered technologies.

Blockchain is a term that creates a lot of uproar in media, business forums as well as casual conversations. Despite the buzz, this concept still arouses considerable confusion. Having emerged in 2008, it was invented to serve as digital ledger technology (DTL), which records and stores transactions of any type in an open platform, primarily focusing on cryptocurrency. In essence, it confirms that transfers of currency are secured and successfully completed.

The main advantages for businesses that make this technology so groundbreaking are distribution and immutability. As blockchain uses distributed databases, it excludes the possibility of failure. Each transaction is recorded in the form of a block, which is fully encrypted, and thus impossible to hack. To break into it, the intruder will have to hack every ‘block’ of the ledger in every location, which is considered impossible.

Being a sharing platform, blockchain gives access to data from DTL for multiple parties, providing benefits such as frictionless decisions on lending or a reduction in fraud costs. According to the World Economic Forum report, 10% of GDP will be stored on blockchains or blockchain-related technologies by 2025.

What are the most essential blockchain applications for financial institutions?

Fraud Prevention

The banking industry invests billions of dollars in advanced detection and verification systems to protect itself and its customers from financial fraud. According to the 2017 ABA Deposit Account Fraud Survey, in 2016, fraud losses accounted for $2.2 billion, which is 16% higher compared to 2014.

Most financial institutions use centralized databases, which are prone to financial crimes. Blockchain-embedded technology helps the banking industry to reduce risks of fraud in major transactions and enhances transparency and security. As transactions are stored in blockchain-powered ledgers, they cannot be changed or deleted.

Know-Your-Customer Solutions

The banking industry uses Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures aimed at the prevention of terrorist financing and money laundering. The annual costs required for the implementation of these measures, according to A Thomson Reuters Survey, are estimated to range from 60 million to 500 million US dollars.

KYC (Know Your Customer) is a process of identification of clients, which is required by financial organizations. Banks normally request customer’s information, such as name, address, work history, etc. in order to perform a financial operation. This process is usually performed by four employees and is vulnerable to errors.

Implementation of this technology can significantly improve KYC processes, making them more effective and less time-consuming. By applying blockchain-powered solutions, bankers do not need to upload raw data from institution databases. Clients can construct and regularly update their profiles by themselves. As a result, financial institutions can considerably reduce their administrative efforts, as well as curtail expenditures.

Smart Contracts

Smart contracts are self-executing contracts, the conditions of which are recorded as a code. The code is placed in a blockchain network, eliminating the need of managing it manually. Such networks connect financial institutions with their clients in a shared system, allowing them to speed up transfer processes, simplify cross-border payments, enhance the accuracy of transactions, and offer the most competitive prices for their services.

Smart Assets Management

Transactions of assets performed on a blockchain overcome the challenge of dispute resolutions as well as reduce the time needed to tackle discrepancies in data sets. The blockchain-embedded technology makes it possible to record and update information about assets in digital form. Smart Asset Management does not only record the movement of the asset but is also able to trace the asset within the whole movement cycle.

Blockchain-Enabled Lending

With the adoption of blockchain-powered technologies, processes of loans and credit underwriting have become more efficient, secure, and cheaper.

Traditionally financial institutions operate credits and loans using outdated reporting systems, like fax exchange between parties to share information on complex deals. Blockchain enables peer-to-peer loans that comply with the syndicated loan structure and provides much faster approval for loan applications and credit cards. Blockchain-enabled lending offers simultaneous access to constantly updated information in a DTL, allowing all parties to exchange data in real-time.

According to Spain’s BBVA, the first bank to apply a syndicated loan based on blockchain technology, this innovation shortened transaction times in the $4.6tn-a-year market.

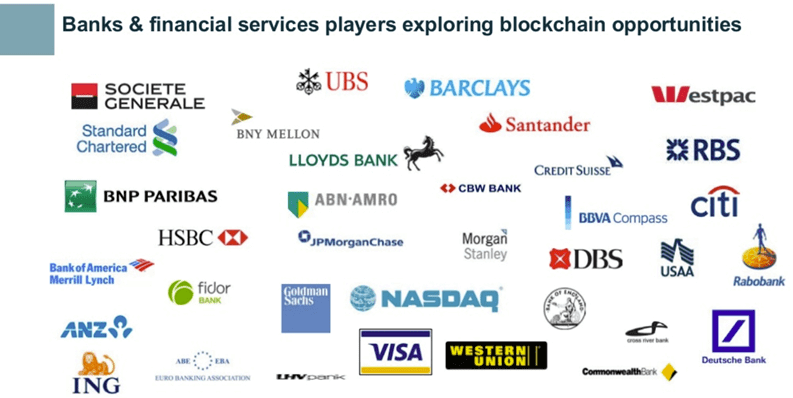

Here are the financial institutions using blockchain:

CEBNet

CEBNet is a Chinese financial news source, reported that 12 out of 26 of China’s publicly listed banks implemented blockchain-based technologies for their business processes. They include the Bank of China, Agriculture Bank of China, China Construction Bank, etc.

According to an IBM study, 66% percent of banks are expected to deploy blockchain in commercial production and at scale by 2020.

JP Morgan Chase

JP Morgan Chase, a US multinational bank, one of the largest financial institutions in the world, has put a lot of faith in blockchain and, in 2017, developed its own blockchain-based payment system, named Interbank Information Network (IIN). After this system had been implemented for over a year, more than 17 different financial institutions started to work with it. IIN can process around 300,000 transactions per day, while the SWIFT payment system manages 14.5 million cross-border transactions a day.

China Construction Bank

China Construction Bank performs cross-border transactions for small businesses on a blockchain-powered platform, streaming transaction processing and increasing service delivery. The Bank declared that with blockchain technology, it has so far performed more than $251 million USD worth of transactions.

Santander

Santander is the first UK bank, which deployed blockchain for international payments. By applying blockchain technology, Santander introduced a new service – Santander One Pay FX, which is able to process cross-border payments live. This exchange platform offers clients to complete cross-border transfers on a 24-hour basis.

Conclusion

While blockchain remains a young technology, many financial institutions are actively exploring its potential and even reaping its benefits. The technology offers the banking industry efficiency, security, speed, and cost reduction, enhancing the quality of financial services and lowering expenditures. As blockchain-embedded technologies envisage the involvement of multiple parties rather than being limited to a single banking system, banks still have to learn to cooperate in order to fully benefit from the possibilities of decentralized networks and technologies.